The Automated Underwriting System (AUS) in Hard Money Loans is revolutionizing the way private lenders evaluate risk and make quicker decisions. Here are 7 ways it's changing the game in real estate lending.

What Is an Automated Underwriting System (AUS)?

An automatic underwriting system (AUS) is a tech-service platform that assesses the borrower profile using set algorithms, data analytics and risk models. Based on old-school manual reviews, AUS software can process the loan applications in a flash by collecting real-time data from various sources such as credit bureau, public records and income databases.

In the Hard Money Lending World-Famous for its early, asset-based lending, Aus is quick, coordinated and scalable underwriting decisions are becoming increasingly popular for your habit to give decisions.

Why AUS Is the Future of Hard Money Lending

As a financial landscape change, automated underwriting systems (AUS) are making their place as the future of hard money lending. Traditionally, the underwriting process has been slow, manual, and often susceptible to human error. But with technology growth, automated debt prevalence is proving to be a game-changer, simplifying the decision-making process and significantly lowering the risk of lapse.

Integration of automated underwriting systems increases the accuracy of evaluating loan applications by transferring through large -scale data in real time. This means that lenders can more accurately and efficiently assess the borrower's risk, which can lead to rapid approval without proper hard work. In addition, with the ability to process applications around the clock, these systems ensure that time-sensitive deals are quickly managed, giving both borrowers to borrowers

In addition, the automatic debt reduces the subject that often affects manual assessment. By relying on data-operated algorithms, these systems reduce prejudice and ensure continuity in decision making. For example, AUs are not only improving operational efficiency but also making the borrowing process more equitable, transparent, and scalable for the future. In a rapid digital world, it is necessary to adopt automated underwriting systems for hard money lenders to stay ahead in a rapidly changing industry.

Key Differences Between AUS and Manual Underwriting

Feature | Manual Underwriting | Automated Underwriting System |

|---|---|---|

Speed | 1–3 business days | Minutes to hours |

Consistency | Depends on underwriter | Rule-based, consistent |

Data Sources | Limited, human-collected | Automated, real-time |

Risk Accuracy | Subjective | Algorithmic and predictive |

Scalability | Labor-intensive | Easily scalable |

How AUS Works in Hard Money Loans

Typically, traditional automatic underwriting systems (AUS), such as Fanny Mae's desktop underwriters, are not used for hard money loans. Standard AUS is designed for traditional borrowings, which makes heavy analysis of a borrower's individual credit, income and debt-to-income ratio.

In contrast, the hard money underwriting is asset-based. Lenders use their ownership, often manual ways, to evaluate the deal. The primary focus is property loan-to-value (LTV) and after the repair value (ARV), not the borrower's financial history. The property is self-communicable, which creates inconsistent, quick, equity-centric evaluation with standard AUS models.

Data Points Reviewed by Automatic underwriting systems

An AUS reviews a wide set of factors, including, but not limited:

Loan score and credit history

LTV ratio (LTV) ratio

Property type and location

Borrower experience (flip or rent)

Cash reserves and income stability

In hard money, property value and project profitability are higher than the traditional debt-to-income ratio.

Role of AI and Machine Learning

Modern AUS platforms are powered by machine learning, which means they learn from past loan performance and adjust risk models accordingly. For example, if multiple loans in a specific ZIP code default, the AUS flags future applications in that area with a higher risk profile. This predictive capability is transforming private lending.

Benefits of AUS for Hard Money Lenders

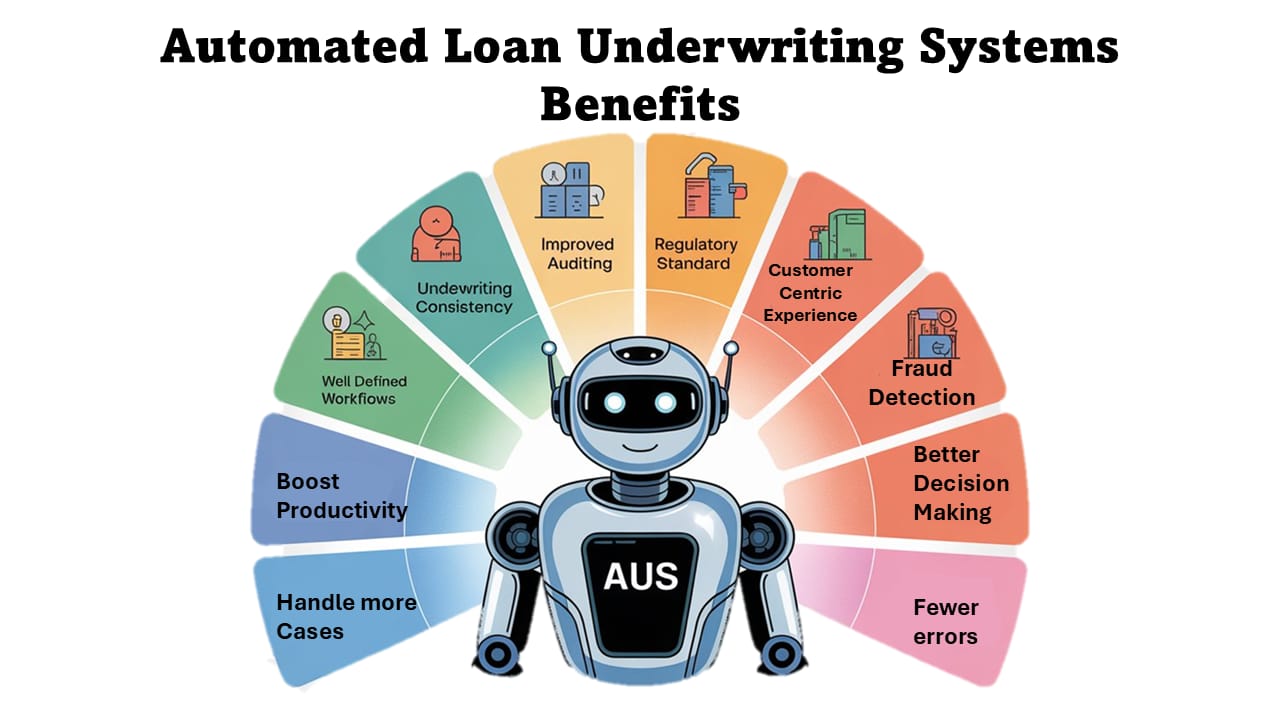

One of the most powerful tools reshaping modern lending is the Automated Loan Underwriting System (AUS). Here's a deeper look at how these systems add immense value to our hard money lending process and why they matter to you as a real estate investor:

Automated Loan Underwriting Benefits

1. Underwriting Consistency

Automated systems apply the same logic and rules to every loan file, reducing human bias and improving fairness in decisions. This leads to consistent and predictable outcomes — something every investor can count on.

2. Improved Auditing

Audit trails are automatically created and easily accessible, making it simpler to verify how underwriting decisions were made. This ensures greater transparency and protects both the lender and borrower.

3. Regulatory Standard Compliance

AUS ensures that every application is evaluated according to the latest federal and state lending guidelines. This reduces the risk of non-compliance, fines, or loan repurchases, keeping our lending practices safe and secure.

4. Well-Defined Workflows

The underwriting process becomes more organized, structured, and trackable. This ensures a smoother journey from application to approval — something Accolend borrowers appreciate every time.

5. Boost Productivity

By automating repetitive tasks, underwriters can focus on more complex loan scenarios and decision-making. This means faster approvals and quicker closings — often in as little as 10 days with Accolend.

6. Better Decision Making

Automated systems analyze large sets of data in seconds, helping lenders make smarter and faster lending decisions based on risk, profitability, and compliance, aligning perfectly with Accolend’s standards.

7. Fraud Detection

With real-time cross-checks and data validation, AUS can detect inconsistencies or suspicious activity early in the process. This ensures we lend on secure and solid deals only.

8. Customer-Centric Experience

Investors want speed and clarity. AUS shortens the waiting time, reduces back-and-forth, and offers more transparency. At Accolend, we combine this tech with one-on-one human support for a winning experience.

9. Handle More Cases Efficiently

Scalability is a game-changer. Automated systems allow lenders like Accolend to handle a larger volume of loan files without sacrificing quality or speed.

10. Automated Process

Gone are the days of manual data entry and paperwork piles. Automation reduces friction, minimizes errors, and gets your funding on track — fast.

11. Fewer Errors

Manual underwriting is prone to oversight. Automation ensures accurate data capture, real-time validation, and fewer underwriting mistakes, making your path to funding much smoother.

12. Cost Savings

Efficiency = savings. By reducing labor-intensive tasks and closing loans faster, lenders cut overhead, and those savings can be passed on to our borrowers through better terms or fewer fees.

Challenges with AUS in the Hard Money Sector

Limited Data Availability

Hard money borrowers may have non-traditional income or multiple LLCs. Sometimes, they’re first-time flippers with no borrowing history. AUS may flag these cases as “high risk” simply due to lack of data—requiring human review.

Unique Property Types

Properties that are distressed, non-conforming, or off-grid may not align with standard AUS models. Lenders must allow manual overrides or hybrid systems that blend automation with expert judgment.

Why hard money lenders don’t use AUS

1. Asset-Based Lending Focus

Hard money creditors base their decisions primarily on the fee of the underlying asset—usually real estate—not on the borrower's creditworthiness or financial profile. AUS structures are constructed to evaluate a borrower's capacity to pay off, not to evaluate property price as the principle component.

2. Speed and Flexibility

AUS follows inflexible, regulations-primarily based guidelines (like the ones from Fannie Mae or Freddie Mac). Hard cash lenders prioritize speed and versatility. They could make exceptions, work around purple flags, and fund offers in days, not weeks—some thing AUS can not do.

3. Non-Conventional Borrowers

Hard cash lenders cater to: Borrowers with negative or no credit Self-hired individuals with complex earnings Investors who want quick bridge loans These profiles often don't meet the slim standards required by way of AUS, that is designed for conforming, traditional borrowers.

4. No Need for GSE Support

AUS is often used for loans to be able to be offered to Government-Sponsored Enterprises (like Fannie Mae or Freddie Mac). Hard money lenders keep the loans themselves or fund them through private capital—they are not promoting them on the secondary marketplace. So there's no incentive to apply AUS.

5. Manual, Common sense underwriting

Hard money lenders rely on manual underwriting, which allows for general knowledge decisions. For example, a property with high equity and concrete resale capacity may be approved regardless of the borrower's income or FICO score - some AUS will be likely to reject.

6. AUS does not handle rehabilitation or construction risk well

Hard money loans are used for Fix and flip loans, Bridge loans, Ground-up construction loans, and DSCR or Rental loans. These scenarios include the draw schedule, later repair price (ARV), and project timelines. AUS is not well designed to assess all such steps of hard money loans.

Future Trends in AUS and Hard Money Lending

Predictive Lending Models

Future AUS platforms won’t just assess current risk—they’ll predict long-term loan performance using historical datasets and market forecasts.

Blockchain-Integrated Underwriting

Blockchain tech can help verify title status, lien positions, and even borrower identity, making AUS smarter and more secure than ever.

FAQs

1. What is the role of AUS in hard money loans?

AUS automates underwriting decisions using data and AI, helping hard money lenders make faster, smarter funding choices.

2. Is AUS suitable for fix and flip loans?

Yes. AUS platforms can assess property values, borrower experience, and ARV, making them ideal for evaluating fix and flip deals.

3. Can borrowers still talk to a real underwriter?

Absolutely. While AUS handles the bulk of analysis, borrowers can still consult underwriters—especially for complex cases.

4. Does AUS reject applications more often?

Not necessarily. It flags risks, but many platforms offer hybrid models that allow manual overrides when needed.

5. Is AUS secure for handling sensitive borrower data?

Yes. Reputable AUS providers use encryption and comply with data privacy standards like SOC 2 and GDPR.

6. How can real estate investors benefit from AUS?

They get faster loan decisions, more consistent results, and fewer documentation requirements—leading to smoother transactions.

Conclusion: Embrace AUS for a Faster, Safer Hard Money Future

The Automated Underwriting System is no longer just a tool for conventional mortgage lenders—it's reshaping the hard money landscape. With faster decisions, improved risk scoring, and reduced overheads, AUS empowers both lenders and investors to scale faster and safer.

As tech advances and competition heats up, embracing AUS isn’t just smart—it’s essential.